26th May 2023 / Opera Theatre Madlenianum / Belgrade

Finticipate Vol. 2:

What the Fintech is Happening?

Welcome to „Finticipate“ a unique fintech event focused on South East Europe. „Finticipate“ is a place for discussion and an idea exchanging hub for fintechs, banks, neobanks, financial experts, public sector investment funds, private equity investors, VCs, consultants and lawyers, futurists, technologist and innovators, looking to contribute and help shape the future of finance.

Agenda 2023

Coffee & Tea

Business and regulatory FinTech trends and challenges to watch out for!

The year in review 2022: What the Fintech Happened? How has the latest financial crisis influenced financial markets and how FinTechs? What new regulations will define how FinTech will operate in the future? Which new market trends are emerging? The cybercrimes – FinTech menace – and how to handle it?

- Post-Covid tech – world earthquake – what are the implications?

- The downfall of BNPL-Is the B(NPL) the new NPL?

- CBDC – the future of the money? Are Central banks in SEE considering issuing digital currencies

- Trending regulations in the EU and its effects on the SEE market: What does MiCA mean for the EU and what for non-EU markets? How is DORA relevant?

- How is the net zero technology trend influencing the traditional financial services market and how FinTechs?

- Cyber threats – In the light of recent frauds, how are fintech market participants adapting their products and services?

Coffee & Tea

Success stories (Banks and FinTechs)

Round 2: Is there enough room for all?

- Banking as a service – trends

- Digital ID is the cornerstone of winning the FinTech race in SEE. What are we waiting for?

- Asset tokenization: is asset tokenization only reserved for the FinTech world or will banks be using this trend to attract new clients?

- The growth of neo-banks and digital-only banks in SEE

- Old (new) faces – Embracing the Change- How are mainstream payment platforms pushing the development of FinTechs?

- Can FinTechs ensure the same AML standards as commercial banks?

Networking break

Open to suggestions by sponsors

Everything, everywhere, and all in the real-time

Improving customer experiences is one of the key engines behind the growth of embedded finance. The new (old) approach to offering financial services typically associated with financial institutions such as banks and insurance companies is creating a world of opportunities for financial service providers and non-financial companies alike. It’s all about offering services when and where people need them.

- Embedded Banking – bank accounts and associated debit cards

- Payments Reinvented – A world beyond credit cards

- Can e-commerce retailers offer banking services?

- BNPLs innovations and challenges

- Can AI revolutionize lending?

- InsurThech – A brave new world

Coffee & Tea

We have seen in the last year some positive examples of asset tokenization. Does this trend open doors for traditional banks and financial and capital markets participants to offer their clients the opportunity to tokenize their current fixed-income and equity asset pools?

Tokens as collaterals? Is the new trend merging? Will tokenization allow access to new revenue streams available in the cryosphere and more specifically enable their clients’ tokenized assets to be used as collateral or for staking in DeFi transactions?

- Smart contracts – use case

- Regulated ReFi vs DeFi – trends and challenges

- Fueling the growth of DeFi: challenging traditional debt markets and the increase in tokenization of assets

- CBDCs vs stablecoins

Coffee & Tea

Calling all investors and startups – The sources of finance in FinTechs are diverse. From venture capital to private equity funds, corporates, banks, asset managers, and even national governments. Find out what conditions, business models, and products they are looking to invest in. Listen to the first-hand experiences on exit strategies from fintech founders.

SUPER EARLY BIRD

€249+VAT / per person

Available until 3 April

STANDARD

€420+VAT / per person

Standard ticket price

START-UP

€150+VAT / per person

For start-up representatives

ONLINE

€99+VAT / per person

Online ticket price

3+ Group ticket

€300+VAT / per person

Registration for 3+ attendees*

*Attendees must be from the same organisation to be eligible for the group discount and must be registered and paid for at the same time.

— I build designs systems for companies

I am an award-winning digital designer from London, in the business of creating unforgettable interactive experiences.

Hub gives you incomparable insight into what your customers are perusing, clicking, and craving.

Hub gives you incomparable insight into what your customers are perusing, clicking, and craving.

Hub gives you incomparable insight into what your customers are perusing, clicking, and craving.

Hub gives you incomparable insight into what your customers are perusing, clicking, and craving.

Hub gives you incomparable insight into what your customers are perusing, clicking, and craving.

Quick facts

01

Finticipate vol.1

Let's talk about the future of Finance. Let's finticipate!

Our goal

One of the Forum’s primary goals is to create a stronger fintech community of professionals and regulators in the South East Europe region and beyond, but also to attract potential investors.

About

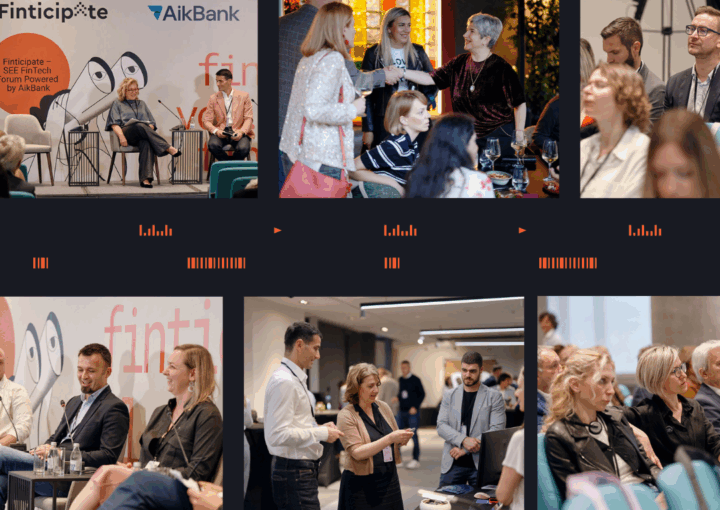

The event tackled some of the most burning topics related to the fintech industry and our amazing speakers shared their vast knowledge on various aspects of their businesses models, fintech solutions, innovative products and regulatory frameworks.

We have put a special focus on enabling participants to freely share their knowledge, best practices and experiences, as well as to help them build stronger business network and develop the fintech market in this part of the world.

Video

02

Photo Galery

03

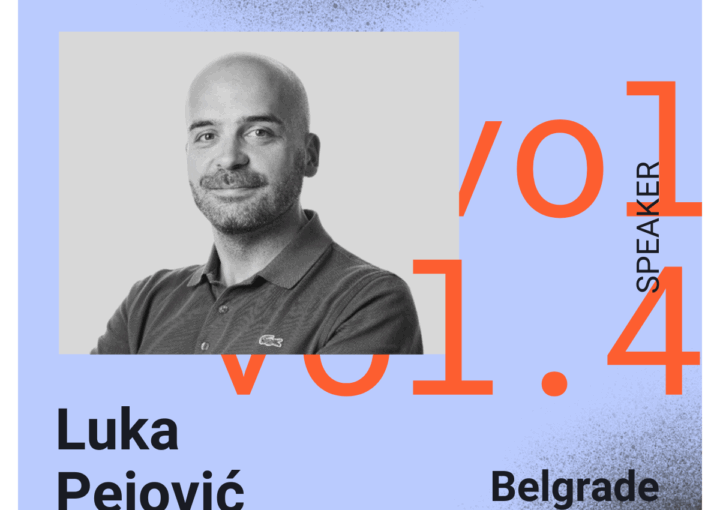

Speakers 2022

04

Director of the Team for IT and Entrepreneurship, Office of the Prime Minister, Government of the Republic of Serbia

Activate.

Participate.

Finticipate.

23 May 2025

Belgrade / Mona Plaza Hotel

Activate.

Participate.

Finticipate.

Key information

Finticipate is a leading meeting place for fintech and finance professionals, regulators, and innovators to connect, share insights, and address key trends and challenges shaping the industry in Central and Southeastern Europe and beyond – all with a focus on meaningful content and impactful discussions! And fun!

Venue location is Mona Plaza Hotel, Cara Uroša 62 – 64, Belgrade.

The simultaneous translation is provided throughout the event (English/Serbian).

Over the last three Finticipate Forums, we welcomed over 450 attendees.

The audience comprised participants from Albania, Austria, Bosnia and Herzegovina, Croatia, Cyprus, France, Hungary, Slovenia, Serbia, Malta, Montenegro, North Macedonia, Switzerland, Sweden, Poland, Romania, Bulgaria, the United Arab Emirates, the United Kingdom, and other countries.

Previous editions of the Forum have attracted representatives from a diverse range of companies, including traditional banks, payment platforms, neobanks, crypto exchanges, Web3 service providers, startups, fintech payment platforms, international fintech associations, financial institutions, BNPL (Buy Now, Pay Later) services, and many more.

Key information

Finticipate is a leading meeting place for fintech and finance professionals, regulators, and innovators to connect, share insights, and address key trends and challenges shaping the industry in Central and Southeastern Europe and beyond – all with a focus on meaningful content and impactful discussions! And fun!

Venue location is Mona Plaza Hotel, Cara Uroša 62 – 64, Belgrade.

The simultaneous translation is provided throughout the event (English/Serbian).

Over the last three Finticipate Forums, we welcomed over 450 attendees.

The audience comprised participants from Albania, Austria, Bosnia and Herzegovina, Croatia, Cyprus, France, Hungary, Slovenia, Serbia, Malta, Montenegro, North Macedonia, Switzerland, Sweden, Poland, Romania, Bulgaria, the United Arab Emirates, the United Kingdom, and other countries.

Previous editions of the Forum have attracted representatives from a diverse range of companies, including traditional banks, payment platforms, neobanks, crypto exchanges, Web3 service providers, startups, fintech payment platforms, international fintech associations, financial institutions, BNPL (Buy Now, Pay Later) services, and many more.

Blind Bird

€250+VAT / per person

Available before 18th February*

*Is a highly discounted ticket available before event details, like the agenda or lineup, are announced. It’s for early supporters.

3+ Group ticket

€320+VAT / per person

Registration for 3+ attendees**

**Attendees must be from the same organisation to be eligible for the group discount and must be registered and paid for at the same time.

STANDARD

€450+VAT / per person

Available after 23rd April

START-UP

€200+VAT / per person

For start-up representatives***

Quick facts

01

Finticipate vol.1

Let's talk about the future of Finance. Let's finticipate!

Our goal

One of the Forum’s primary goals is to create a stronger fintech community of professionals and regulators in the South East Europe region and beyond, but also to attract potential investors.

About

The event tackled some of the most burning topics related to the fintech industry and our amazing speakers shared their vast knowledge on various aspects of their businesses models, fintech solutions, innovative products and regulatory frameworks.

We have put a special focus on enabling participants to freely share their knowledge, best practices and experiences, as well as to help them build stronger business network and develop the fintech market in this part of the world.

Video

02

Photo Galery

03

Speakers 2022

04

Director of the Team for IT and Entrepreneurship, Office of the Prime Minister, Government of the Republic of Serbia

Activate.

Participate.

Finticipate.

23 May 2025

Belgrade / Mona Plaza Hotel

Activate.

Participate.

Finticipate.

Key information

Finticipate is a leading meeting place for fintech and finance professionals, regulators, and innovators to connect, share insights, and address key trends and challenges shaping the industry in Central and Southeastern Europe and beyond – all with a focus on meaningful content and impactful discussions! And fun!

Venue location is Mona Plaza Hotel, Cara Uroša 62 – 64, Belgrade.

The simultaneous translation is provided throughout the event (English/Serbian).

Over the last three Finticipate Forums, we welcomed over 450 attendees.

The audience comprised participants from Albania, Austria, Bosnia and Herzegovina, Croatia, Cyprus, France, Hungary, Slovenia, Serbia, Malta, Montenegro, North Macedonia, Switzerland, Sweden, Poland, Romania, Bulgaria, the United Arab Emirates, the United Kingdom, and other countries.

Previous editions of the Forum have attracted representatives from a diverse range of companies, including traditional banks, payment platforms, neobanks, crypto exchanges, Web3 service providers, startups, fintech payment platforms, international fintech associations, financial institutions, BNPL (Buy Now, Pay Later) services, and many more.

Key information

Finticipate is a leading meeting place for fintech and finance professionals, regulators, and innovators to connect, share insights, and address key trends and challenges shaping the industry in Central and Southeastern Europe and beyond – all with a focus on meaningful content and impactful discussions! And fun!

Venue location is Mona Plaza Hotel, Cara Uroša 62 – 64, Belgrade.

The simultaneous translation is provided throughout the event (English/Serbian).

Over the last three Finticipate Forums, we welcomed over 450 attendees.

The audience comprised participants from Albania, Austria, Bosnia and Herzegovina, Croatia, Cyprus, France, Hungary, Slovenia, Serbia, Malta, Montenegro, North Macedonia, Switzerland, Sweden, Poland, Romania, Bulgaria, the United Arab Emirates, the United Kingdom, and other countries.

Previous editions of the Forum have attracted representatives from a diverse range of companies, including traditional banks, payment platforms, neobanks, crypto exchanges, Web3 service providers, startups, fintech payment platforms, international fintech associations, financial institutions, BNPL (Buy Now, Pay Later) services, and many more.

Blind Bird

€250+VAT / per person

Available before 18th February*

*Is a highly discounted ticket available before event details, like the agenda or lineup, are announced. It’s for early supporters.

3+ Group ticket

€320+VAT / per person

Registration for 3+ attendees**

**Attendees must be from the same organisation to be eligible for the group discount and must be registered and paid for at the same time.

STANDARD

€450+VAT / per person

Available after 23rd April

START-UP

€200+VAT / per person

For start-up representatives***